LTV Calculator

What is Customer Lifetime Value (LTV)?

Customer Lifetime Value (LTV, or CLV) is a crucial metric that predicts the total net profit a business can expect to generate from a single customer over the entire duration of their relationship. Unlike metrics that focus on a single transaction, LTV provides a long-term perspective on the value of each customer.

Understanding LTV helps businesses make important decisions about marketing, sales, product development, and customer support. It shifts the focus from short-term gains to long-term, sustainable growth built on strong customer relationships.

Customer Lifetime Value (LTV) Calculator

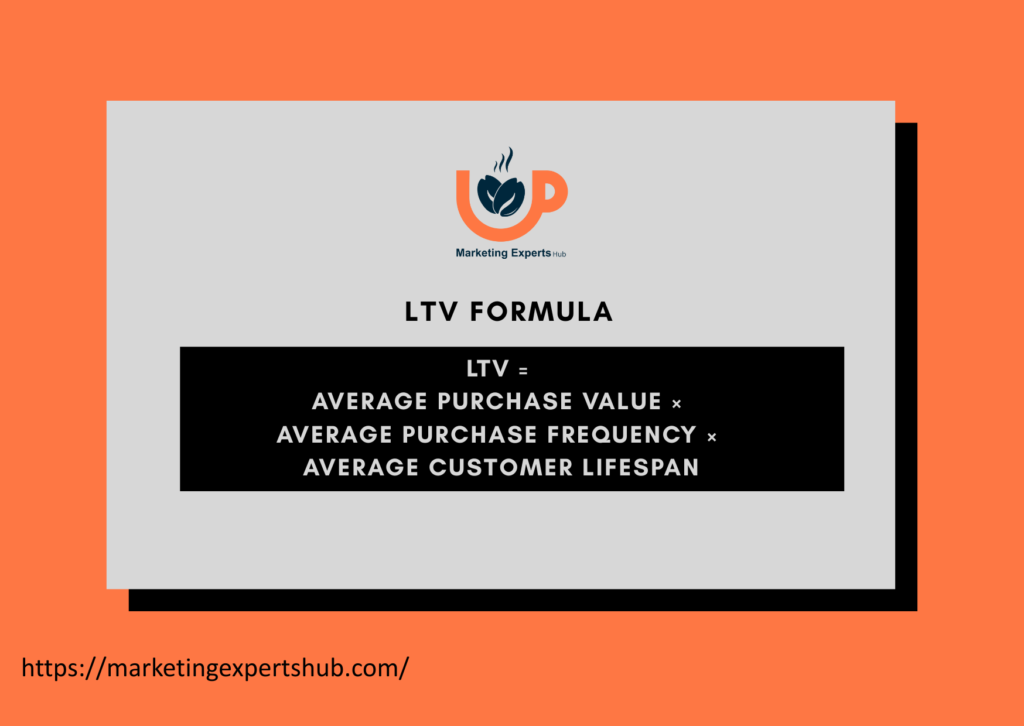

The LTV Formula

There are several ways to calculate LTV, but a common and straightforward formula is:

LTV = Average Purchase Value × Average Purchase Frequency × Average Customer Lifespan

Where:

- Average Purchase Value: The average amount of money a customer spends on each purchase. (Calculated as: Total Revenue / Number of Purchases)

- Average Purchase Frequency: The average number of times a customer makes a purchase in a specific period (e.g., per year). (Calculated as: Total Purchases / Number of Unique Customers)

- Average Customer Lifespan: The average length of time a customer continues to do business with your company.

Why is Calculating LTV Important?

Calculating and monitoring LTV is essential for sustainable business growth:

- Profitability Insights: It reveals which customer segments are the most profitable over time, allowing you to focus your efforts effectively.

- Marketing Budget Allocation: LTV helps you determine your Customer Acquisition Cost (CAC). Knowing what a customer is worth allows you to decide how much you can afford to spend to acquire them.

- Customer Retention Strategy: A low LTV might signal issues with customer satisfaction or loyalty. It highlights the importance of retention efforts, as improving LTV is often more cost-effective than acquiring new customers.

- Forecasting Revenue: LTV provides a more accurate basis for long-term revenue projections and financial planning.

How to Use the LTV Calculator

Our tool simplifies the process of calculating Customer Lifetime Value.

- Enter Average Purchase Value: In the first field, input the average amount a customer spends per transaction.

- Enter Average Purchase Frequency: In the second field, input how many times a customer typically buys from you in a given period (e.g., per year).

- Enter Average Customer Lifespan: In the final field, enter the average number of periods (e.g., years) a customer stays with you.

- View Your LTV: The calculator will instantly display the estimated Lifetime Value of a customer.

What is a “Good” LTV?

The value of LTV is best understood when compared to your Customer Acquisition Cost (CAC). The LTV:CAC ratio is a powerful indicator of your business’s health and marketing efficiency.

- A ratio of 1:1 means you are losing money on every customer you acquire.

- A ratio of 3:1 is widely considered a healthy benchmark, indicating a profitable and sustainable business model.

- A ratio of 5:1 or higher suggests you have a very strong business model and may be underinvesting in marketing. You could likely grow faster by increasing your acquisition spending.

How to Improve LTV

To increase your Customer Lifetime Value, you can focus on improving each component of the formula:

- Increase Average Purchase Value: Encourage customers to spend more per transaction through upselling, cross-selling, and product bundling.

- Increase Average Purchase Frequency: Motivate customers to buy more often through loyalty programs, email marketing, regular promotions, and by creating products that require repeat purchases.

- Increase Average Customer Lifespan: Focus on building strong relationships and improving customer loyalty. This can be achieved through excellent customer service, building a strong brand community, and consistently delivering value.